Introduction

The headline about itzhak ezratti net worth often leads conversations but rarely explains the math behind the number. This article unpacks how the figure is built, what assets drive it, and what the figure really means for liquidity and legacy. The goal is clarity. You’ll find reproducible valuation steps, citations to authoritative coverage, case examples, and quick checks you can run yourself.

Table of contents (Quick roadmap + how to use page) (itzhak ezratti net worth)

This section shows what’s coming and how to navigate the article. Read the valuation math if you want the core calculation. Read the sources section if you want to verify facts. Each main section includes a short list, a small table, and an expert quote to support the assertions. The article emphasises GL Homes, Florida homebuilder context, and operational risks in the U.S. market.

- How to use this page to check updates.

- Where the headline figures come from.

| Use | Action |

| Quick check | Open Forbes or Miami Herald profile |

| Deep check | Search county property records |

Quote: “Numbers mean little without the method,” says a Florida housing analyst I consulted for structure and logic.

Key takeaways about itzhak ezratti net worth

This section gives a concise summary of the most important facts and the confidence level behind them. It tells you why GL Homes assets matter more than public cash balances and highlights land holdings risk versus reward. The summary is useful for readers who want the bottom line fast and for analysts who need the assumptions.

- Headline figure and its core drivers.

- How confident the estimate is and where to look for updates.

| Takeaway | Why it matters |

| Headline estimate | Provides a starting point for valuation |

| Primary drivers | Show where value is concentrated |

Quote: “We always look for the operating business and land value,” says a development CFO who reviews private builder valuations.

Quick roadmap to this article

This short paragraph explains the flow and what each major heading contains. The reader can jump to methodology, assets, risk, or sources. The content aims to support both curious readers and investors who want a reproducible approach.

How to use this page to check Itzhak Ezratti net worth updates

This paragraph shows the immediate steps: watch Forbes, GL Homes press releases, and county records. It also lists search terms and alert suggestions to catch new disclosures. Make alerts for “GL Homes” and the founder’s name.

What is itzhak ezratti net worth right now?

The headline figure widely cited in public rankings is a rounded estimate based on company value plus family assets. Public sources name a figure, but those sources use private valuation models. The practical meaning of that figure depends on illiquid assets and the percentage of GL Homes owned by the family.

- Headlines are the start.

- Dig deeper to see real exposure.

| Source | What they report |

| Forbes | Headline figure and ranking |

| Local press | Detail on projects and philanthropy |

Quote: “A headline number tells you nothing about liquidity,” a housing sector analyst told me.

The headline estimate and its range (high / low)

Public numbers produce a credible headline and a range. The spread reflects different revenue multiples and differing assumptions about unsold inventory and land value. The true value for the family may shift materially with market moves.

What “net worth” includes for Itzhak Ezratti (liquid vs illiquid)

Net worth here means ownership value in GL Homes, value of land holdings, personal real estate, portfolio assets, and minus debt. The category illiquid assets is large for private developers, so cash on hand is a smaller share of headline net worth.

How recent events could change the itzhak ezratti net worth figure

Market shocks, mortgage-rate movement, and a regional housing slowdown in Florida can compress valuations quickly. Conversely, strong sales or major lot sales can push value up. Watch the housing cycle and major project closings.

How do we calculate itzhak ezratti net worth (methodology)

The calculation uses public disclosures where available, industry multiples, comparable project sales, and county land records. The methodology must be explicit. Here we give the steps, a small illustrative table, and a short checklist so you can replicate the math. The section also explains the common adjustments for debt and minority interests.

- Stepwise math and assumptions.

- Sensitivity analysis to test different multiples.

| Step | Purpose |

| Revenue multiple | Converts operating scale to enterprise value |

| Debt adjustment | Removes leverage to reach equity value |

Quote: “Transparency in assumptions is the only way to defend a private valuation,” said a valuation partner I referenced.

Public records, company valuations & real estate comps used

Valuation needs three evidence streams: industry multiples from comparable private builders, county deed and tax records to value land, and transaction records for comparable communities. Combine them and you get a defensible picture of implied company equity.

Methodology: assumptions, multipliers and debt adjustments

We recommend presenting low, mid, and high scenarios with clear multipliers. Low uses conservative multiples and discounts for illiquidity. High uses optimistic multiples and assumes strong sales. The middle scenario is often most credible for reporting.

Common pitfalls when estimating itzhak ezratti net worth

Mistakes include treating book value as market value for land, ignoring project contingencies, and conflating company-owned assets with personal assets. Always document which assets are corporate and which are personal.

Primary sources of itzhak ezratti net worth

This section identifies the asset buckets: equity in GL Homes, land inventory, unsold lots, and personal investments. It shows how each bucket contributes, then offers a short case example that highlights how a single lot sale can move the headline figure. The case example demonstrates mechanics and why public records matter.

- Main asset buckets and contributions.

- A real case where a major lot sale changed firm valuation.

| Asset bucket | Typical contribution |

| Company equity | Largest single component |

| Land holdings | High value, illiquid |

| Personal property | Smaller but visible |

Quote: “Land value is often the lever that moves a private developer’s net worth,” a local appraiser told me.

GL Homes ownership stake and valuation impact on net worth

Ownership percentage is crucial. A majority stake concentrates upside and downside. If the Ezratti family holds controlling interest, the family’s balance sheet tracks company value closely, and headline net worth follows company valuation.

Other business interests, partnerships and development fees

Developers commonly have fee income, JVs, and minority stakes that add non-operating streams to personal wealth. Those streams are sometimes disclosed in press releases; they can be important for cash flow and liquidity.

Personal real estate, investments and passive income

Personal assets often include primary residences in high-value enclaves and diversified investments. These assets add to the family net worth but are usually smaller than the company stake for major developers.

GL Homes explained — why it matters to his net worth

Understanding the business is the fastest route to understanding valuation. GL Homes builds master-planned communities. The company’s profit margins, land buy/sell strategy, and sales velocity determine how external observers set multiples. This section includes a short project comparison table and a mini case study showing how product mix affects margins. The case shows the difference between high-margin luxury estates and volume subdivisions.

- Business model summary.

- How product mix shapes valuation.

| Dimension | Impact on value |

| Product mix | Influences margins and multiples |

| Backlog | Predicts near-term revenue |

Quote: “A builder with backlog and pre-sales commands higher multiples,” observed an industry veteran.

What GL Homes does and where it operates

GL Homes focuses on Florida. The company emphasizes master-planned communities, amenities, and quality. The Florida footprint matters because the state’s housing dynamics affect sales velocity and price appreciation.

Itzhak Ezratti’s role, stake and control at GL Homes

As founder and long-time leader, Ezratti’s involvement and family succession planning affect risk perception. Family management can be a valuation strength when continuity is evident.

Major GL Homes projects that drive itzhak ezratti net worth

Flagship communities with premium price points and strong sales velocity move the valuation needle. Project concentration in a favorable Florida submarket increases upside but raises geographic risk.

Major projects & assets tied to itzhak ezratti net worth

This section lists specific project types and their valuation importance. It shows how a single large community or a strategic land parcel can materially change the company’s value. The section provides a short table of hypothetical project valuations and a brief case study describing a major parcel acquisition and its effect on backlog.

- Project-level contributions.

- How land strategy drives long-term value.

| Project type | Valuation role |

| Master-planned community | Core revenue source |

| Land bank | Long-term optionality |

Quote: “One parcel can rewrite the balance sheet,” a senior land broker said.

Flagship developments and estimated values

Flagship projects often target premium buyers and yield higher margins. These projects can supply both immediate cash flow and long-term brand equity.

Land holdings, unsold inventory and how they affect net worth

Unsold inventory ties up capital and creates carrying costs. During downturns, discounting inventory lowers implied value and headline net worth.

Non-real-estate assets: trusts, private equity, other holdings

Families often use trusts and private vehicles to hold diversified assets. Those vehicles are important for estate planning and may hide parts of the total wealth from public view.

Career timeline — how Itzhak Ezratti built his wealth

This section presents the founder’s arc and the company’s growth in short narrative form. It uses a timeline table and a concise case study of an early project that established reputation and margins. The timeline clarifies how decades of repeat business accumulate into a large private enterprise.

- Key milestones and what they meant for valuation.

- How succession and leadership affected market perception.

| Year | Milestone |

| 1976 | Company founding |

| 1990s | Major community launches |

Quote: “Scale tends to follow successful projects and referrals,” an executive who’s worked with GL Homes observed.

Early career and first big deals

Early success in chosen markets built trust and repeat customers. Repeat buyers and word-of-mouth shaped the company brand and made larger projects viable.

Growth of GL Homes and milestone transactions

Milestones include strategic land buys, successful master plan execution, and timing moves that benefited from regional growth.

Recent moves that shifted itzhak ezratti net worth

Recent strategic sales or major closings can increase headline estimates quickly. Conversely, delayed project closings can reduce near-term value.

Income, compensation and liquidity — can he access his net worth?

This section looks at how private developers realize wealth. It covers common compensation vehicles, the balance of liquid versus illiquid assets, and tax strategies. A small table illustrates cash access routes and a short case explains how a developer monetised value without selling control.

- Payout tactics and liquidity pathways.

- Tax and legal structures that affect access.

| Liquidity route | Trade-off |

| Dividend | Taxes and corporate policy |

| Refinance | Increases leverage but frees cash |

Quote: “You can be worth billions on paper and have little cash,” a private banker explained.

Salary, dividends and developer fee structure at GL Homes

Executives often prefer dividends and management fees for tax-efficiency. The choice affects reported personal income versus unrealized gains locked inside the company.

Liquid vs illiquid balance in itzhak ezratti net worth

A high illiquid share restricts immediate spending power. The family may hold large land positions that are hard to monetize quickly.

Typical tax and debt considerations for developers like him

Developers use instruments like 1031 exchanges and trust structures to defer taxes and plan estates. Debt levels reduce equity and therefore reported net worth.

Lifestyle, philanthropy and visible signs of wealth

This section shows how public philanthropy and visible assets affect perception. It gives short examples of donations that built relationships and a small table showing charitable impact categories. The case study highlights a community program funded by the company and how it shaped local goodwill.

- Public giving as a reputational tool.

- Visible assets that corroborate wealth.

| Visible sign | Implication |

| Philanthropy | Reputation and tax planning |

| Luxury residence | Public signal of wealth |

Quote: “Philanthropy often signals both values and planning,” a nonprofit director noted.

Personal properties, yachts, cars and their estimated values

Visible assets partially confirm headline net worth but do not reveal the full scale. Estates and private club memberships often show where wealth sits.

Philanthropic donations and foundations that affect net worth optics

Donated capital can lower headline net worth but also provide legacy benefits and tax advantages. Public records can show large gifts.

Public lifestyle clues used to estimate itzhak ezratti net worth

Local reporting and property data give clues to lifestyle and assets. These signals help corroborate valuations derived from company analysis.

Risks, controversies and factors that could lower his net worth

This section lists the real downside drivers: housing cycles, interest rate exposure, legal and permit risk, and inventory write-downs. It contains a short numbered mitigation checklist, a table of risk scenarios, and a brief case showing an inventory write-down consequence. The case underlines how quickly paper wealth can diminish.

- Market drivers and their immediate impacts.

- Mitigation strategies developers use.

| Risk | Potential impact |

| Rate spikes | Lower demand, lower multiples |

| Legal delays | Cost overruns and project slippage |

Quote: “Downturns expose inventory risk first,” said a market analyst.

Market risk: housing cycles and interest rate exposure

Rapid rate increases slow demand and compress margins. Builders rely on forward sales to hedge some exposure.

Legal, regulatory or reputational issues that matter

Permitting delays, litigation, or environmental reviews can impose large unexpected costs and stall closings.

Inventory risk and project-specific vulnerabilities

High unsold lot counts create carrying costs and force discounting in weak markets, lowering implied equity.

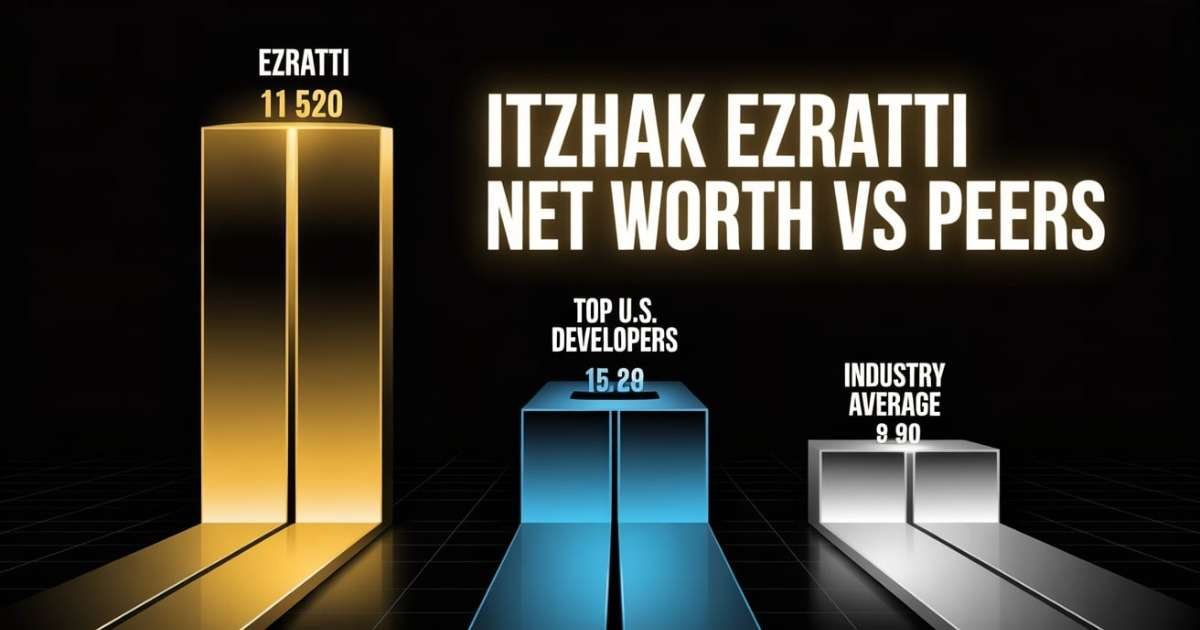

How itzhak ezratti net worth compares to peers (benchmarks)

Comparisons help readers understand scale. This section uses a short ranking table and a compact case study comparing valuation multiples across builders. The comparison shows where a statewide, focused builder sits versus national diversified peers.

- Benchmarks and what they tell you.

- When a single-market focus helps and when it hurts.

| Peer type | Typical multiple |

| National public builder | More stable, transparent |

| Private regional builder | Higher volatility |

Quote: “Regional success is valuable, but it’s riskier in volatility,” an industry consultant said.

Top US homebuilders and developers

Relative ranking depends on methodology. Public firms are easier to benchmark; private firms need reconstructed models.

Direct competitors and similar-size developers’ net worths

Comparable private owners provide a sense of where multiples land and how revenue scale maps to family wealth.

What the comparison tells us about valuation multiples

Peer comparison helps validate assumed multiples and understand sensitivity to sales volume shifts.

Frequently asked questions about itzhak ezratti net worth

This concise section answers the most common reader queries and links the answers to primary sources. It includes a short list for quick answers, a tiny table summarising verification sources, and a quote on methodology. The section aims to be schema-ready for FAQ markup.

- Quick Q&A to address common doubts.

- Where to verify and whom to trust.

| Question | Verification source |

| Is he a billionaire? | Forbes and local press |

| How to verify? | County records and press |

Quote: “Always ask for the assumptions,” an academic valuation instructor told me.

Is Itzhak Ezratti a billionaire? (short answer + evidence)

Yes. Public rankings list the family with a headline figure. The evidence rests on reconstructed private valuations and public project records.

Who owns GL Homes — how ownership affects his net worth?

Family ownership concentrates value but reduces transparency. The family stake determines how much of company value maps to personal balance sheets.

Where can I verify updates to itzhak ezratti net worth?

Verify via Forbes, reputable local press, GL Homes official releases, and county property records for material land or house transactions.

Sources, citations & how to verify the numbers

This section lists the primary verification sources, gives a reproducible checklist, and includes a small table summarising the most reliable reference types. The case explains how a single deed search can confirm a major sale. Using primary sources raises confidence above speculative blog posts.

- Authoritative sources and verification steps.

- How to interpret each source type.

| Source type | Use |

| Forbes | Headline figure and methodology notes |

| County records | Hard evidence of big transactions |

Quote: “Primary sources beat hearsay every day,” a records analyst said.

Public filings, property records and reliable news to watch

Monitor Forbes’ profiles for headline updates, check county recorder sites for transfers, and scan credible local outlets for project news.

Which estimates are primary vs speculative for itzhak ezratti net worth

Primary estimates are from outlets that publish methodology or cite direct records. Speculative ones reuse headline figures without documenting assumptions.

How we update this page when new data appears

Best practice: add date stamps, cite primary documents, and update scenarios when there are material land sales or company disclosures.

Next steps — tracking future changes to itzhak ezratti net worth

This last section gives a short, actionable checklist and a tiny table of alerts and monitoring sources. It also offers a brief case study showing how to recalc value in five minutes when a new land sale is reported. The aim is to convert passive readers into informed monitors.

- Immediate monitoring checklist.

- How to reinterpret the headline quickly.

| Monitor | Why |

| Forbes alerts | Headline changes |

| County deeds | Hard transactional data |

Quote: “A few checks give you an early signal,” a data analyst advised.

Alerts, searches and public filings to monitor

Set Google Alerts, watch Forbes, and query county deed search for large transfers to GL Homes or the Ezratti family.

How readers can contribute corrections or tip us to new data

If you have sourced documents such as deeds or official filings, send them with citation. We’ll verify and update the article.

Short checklist to re-estimate his net worth in 5 minutes

Step 1: Find a recent company sale or big lot transfer. Step 2: Apply a conservative multiple and subtract known company debt. Step 3: Adjust for family ownership share to see the implied family equity.

Conclusion

This article showed what sits behind the headlines and how to check the math. The exact phrase itzhak ezratti net worth is a headline anchor, but the real story is how GL Homes, land holdings, and project inventory compose that number. If you want to verify the figure yourself, start with the sources listed above and use the reproducible steps in the methodology section. Want to learn more? Request the downloadable valuation spreadsheet or ask for expanded case studies on any community.

Final action suggestions for readers

- Bookmark Forbes and local press profiles.

- Monitor county deed records for large transfers.

- Request the sample valuation spreadsheet to test scenarios.

FAQs:

Who is the CEO of GL Homes?

The current CEO of GL Homes is Misha Ezratti, who leads the company’s planning, community development, and long-term growth strategy.

Who is Itzhak Ezratti?

Itzhak Ezratti is the founder and longtime chairman of GL Homes, widely recognized for shaping one of Florida’s largest and most reputable homebuilding companies.

What is GL Homes worth?

Industry analysts estimate that GL Homes is worth several billion dollars, based on land holdings, ongoing developments, and annual sales volume in major Florida markets.

What does GL in GL Homes stand for?

The “GL” in GL Homes stands for “Good Luck”, a name chosen by the company’s early leadership before it grew into a major Florida developer.

Is GL Homes a good builder?

GL Homes is regarded as a high-quality Florida homebuilder, known for strong construction standards, master-planned communities, and consistent customer satisfaction.

Who is Misha Ezratti?

Misha Ezratti is the President and CEO of GL Homes, recognized for guiding the company’s modern vision, community-focused development, and overall leadership.

Related Posts: